Community collects all comments and/or appeals and then forwards those on to the department for final evaluation. Step 4-Expanded Appeal Process: A 90-day appeal period set by the NFIP during which the public can submit comments (base map feature changes) and appeals (Special Flood Hazard Area/regulatory floodway changes) to the preliminary FIRMs.

The preliminary maps are made available to local officials and the public for review during an open house.

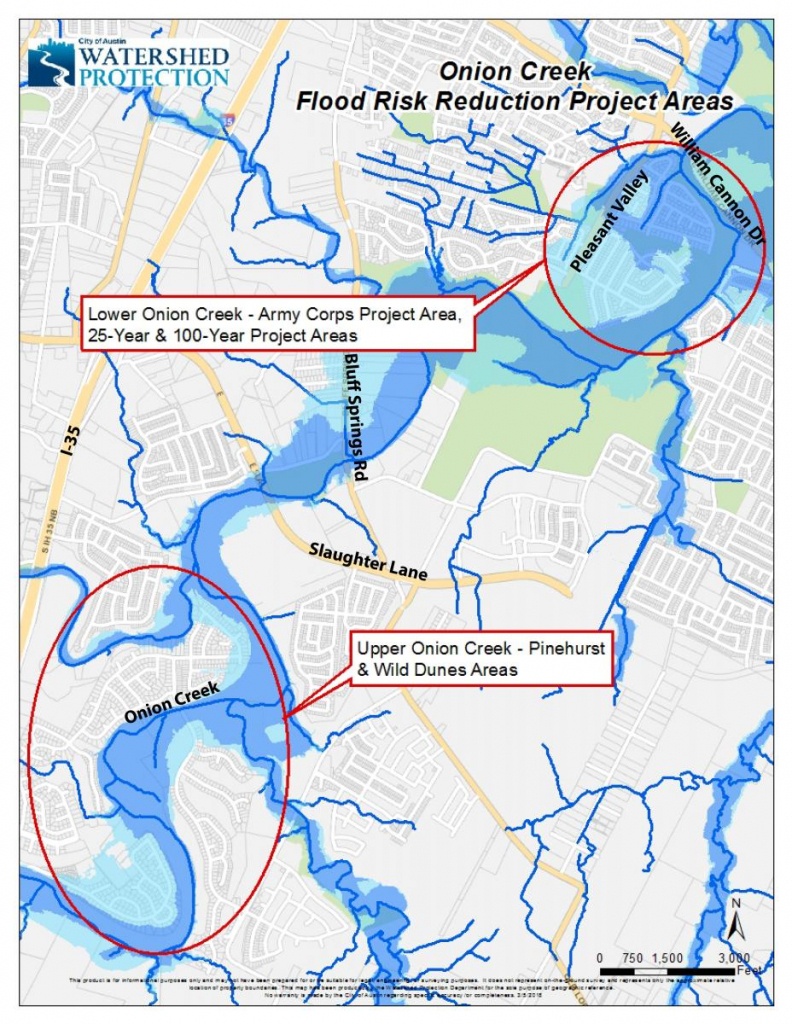

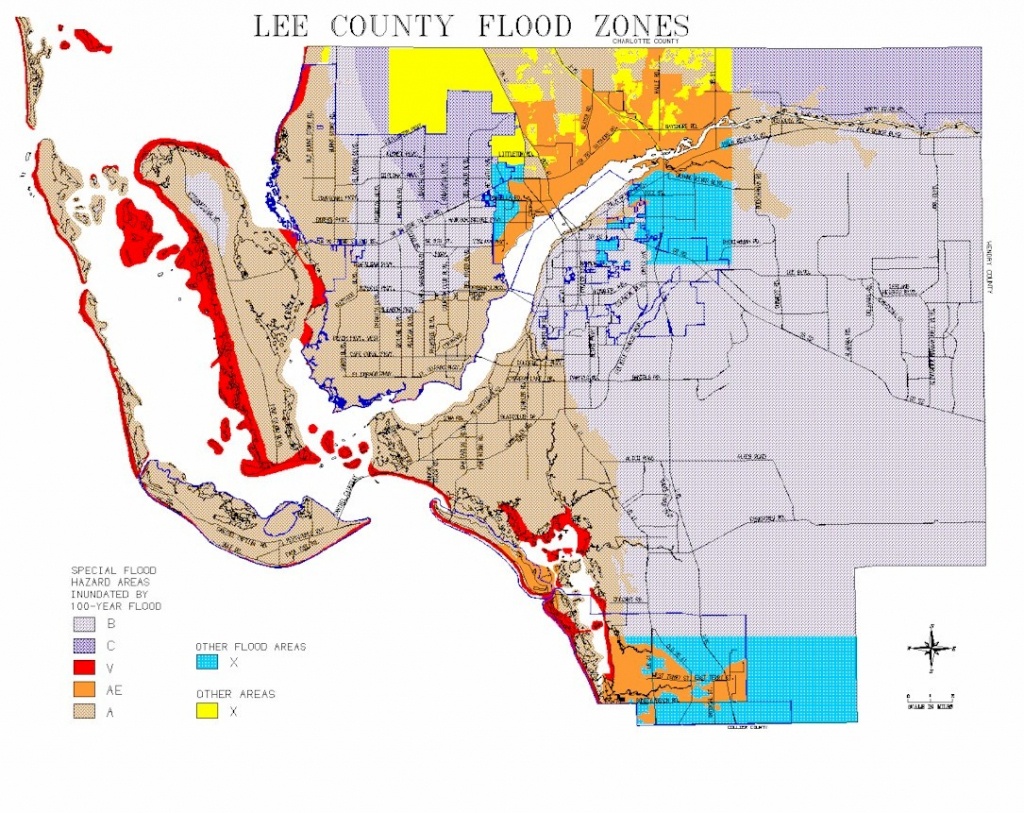

#100 YEAR FLOOD MAPS SERIES#

There is also a series of raster datasets that shows the depth of the flood for various events.

Communities can use this to identify new areas of risk. These products include a new layer that shows the changes since last firm. This is done by creating some new products for the communities. The purpose of Risk MAP is to identify the risk at a location and mitigate that risk. the countywide approach used previously). Risk MAP is a new multi-year FEMA program using a watershed approach (vs. Risk MAPįEMA implemented Risk MAP (Mapping, Assessment and Planning) in 2010, the next phase in floodplain mapping now that the map modernization phase is complete. In addition, engineering input models and flood insurance study text can be downloaded within the mapping application by identifying a reach in the Analysis Lines layer. The spatial data displayed on the DFIRMs is incorporated into FEMA's National Flood Hazard Layer which can be viewed on DNR's mapping application.

#100 YEAR FLOOD MAPS DOWNLOAD#

Light Detection and Ranging (LiDAR) elevation data is used for all current and future DFIRM production in Wisconsin.ĭFIRMs are available for download at FEMA's Map Service Center. In addition, the best available terrain data is used in the mapping process, which results in higher quality mapping products. The DFIRMs show areas at risk to flooding overlain on aerial photos. The newer maps are called Digital Flood Insurance Rate Maps (DFIRMs).

#100 YEAR FLOOD MAPS UPGRADE#

In 2003, FEMA implemented a map modernization initiative to upgrade and distribute the maps in a digital format rather than on paper. In the past, Flood Insurance Rate Maps were produced by FEMA and distributed on paper. To learn more about using the maps visit FEMA's FIRM Tutorial and FIS Tutorial. Effective FIRMs and Preliminary FIRMs are available on FEMA's Map Service Center. Newer FIRMs use aerial photos as the base layer making it easier to determine if a structure or property is within a mapped floodplain. Using the mapsįlood Insurance Rate Maps (FIRMs) are maps of areas at risk to flooding also known as floodplains or Special Flood Hazard Areas (SFHA). The FIRMs can be changed through Letters of Maps Change (LOMCs). The FIRMs are based on engineering studies called Flood Insurance Studies (FIS). The Federal Emergency Management Agency (FEMA) produces Flood Insurance Rate Maps (FIRMs) that show areas at risk to flooding.

0 kommentar(er)

0 kommentar(er)